If you’re expecting a tax refund this season, you can avoid delays by filing a complete and accurate return. But first, you’ll need to gather your tax forms.

You get tax forms such as W-2s and 1099s from employers and financial institutions each year. Those entities also send the IRS copies, called “information returns.” Skipping forms on your return could halt processing.

“It’s the [IRS] matching software that’s the biggest, most consistent problem for taxpayers,” said Bill Smith, national director of tax technical services at financial services firm CBIZ MHM.

Since the IRS already has a copy of your tax forms, its software can easily flag missing forms, Smith explained.

Mistakes will require you to send an amended return and that’s going to slow down the system even further, said Henry Grzes, lead manager of tax practice and ethics with the American Institute of CPAs.

Even if you can submit the amended return electronically, it’s typically processed manually, which can take months, said Tom O’Saben, an enrolled agent and director of tax content and government relations at the National Association of Tax Professionals.

“That is still a manual and very labor-intensive process,” he said, stressing the importance of filing an accurate return the first time by having all your tax forms ready.

Here’s a list of some of the most common tax forms and when to expect them.

When to expect tax forms

While many tax forms must be sent by Jan. 31, others won’t arrive until mid-February or beyond. “Information returns come in later and later every year,” Smith said.

For earnings, common forms may include a W-2 for wages, 1099-NEC for contract or gig economy work, 1099-G for unemployment income and 1099-R for retirement plan distributions.

While most taxpayers will receive forms from their employers or financial institutions, some may not, especially for small amounts.

“You can’t just say, ‘I didn’t get a slip, so, therefore, I don’t have to report the income,'” said Grzes. “If it’s income, you have to report the income.”

Don’t assume you’ll get a mailed paper form, either. With more financial institutions going paperless, you may have to download tax forms, such as savings account interest or investment earnings, from your online accounts.

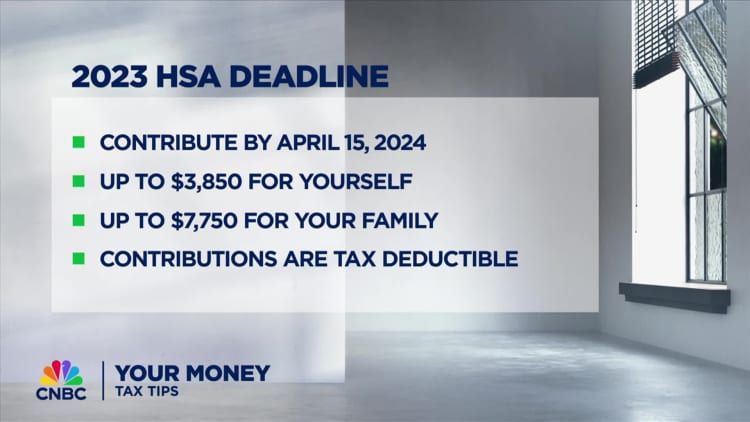

For tax breaks, you may need forms 1098 for mortgage interest, 5498 for individual retirement account deposits, 5498-SA for health savings account contributions, 1098-T for tuition, 1098-E for student loan interest and more.

Of course, corrected tax forms may take longer because your employer or financial institution has to reissue the documents.

The ‘first thing’ you need to get organized

If you’re unsure which tax forms you need, Smith suggested reviewing last year’s return.

“That’s the first thing you should do to get ready for taxes,” he said.

For example, you may have the same employers, income from financial institutions and similar tax breaks.

But if things changed or if this is your first time filing a return, think about what happened in your life last year, places you worked or things you sold, O’Saben said.

Don’t miss these stories from CNBC PRO: