Amazon is lagging its chief rival Flipkart in India on several key metrics and struggling to make inroads in smaller Indian cities and towns, according to a report by investment firm Sanford C. Bernstein.

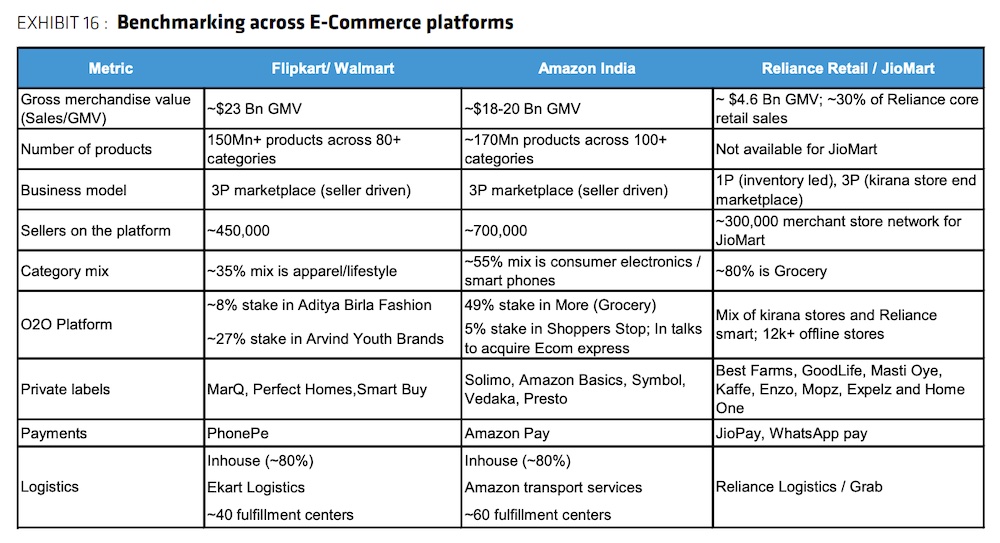

The American e-commerce giant’s 2021 gross merchandise value in the country, where it has deployed over $6.5 billion, stood between $18 billion to $20 billion, lagging Flipkart’s $23 billion, the analysts said in a report to clients Tuesday that was obtained by TechCrunch. The company’s recent spendings for growth in India has also made profitability “elusive,” the report added.

India is a key overseas market for Amazon, where it competes with Mukesh Ambani’s Reliance Retail, Walmart-owned Flipkart and social commerce startups SoftBank-backed Meesho and Tiger Global-backed DealShare. Amazon has so far offered “a weaker proposition in ‘new’ commerce” in the country, the report added.

At stake is one of the world’s last great growth markets. The e-commerce spending in India is expected to double in size to over $130 billion by 2025.

Amazon didn’t immediately respond to a request for comment.

“Amazon has struggled to scale volumes in higher-margin categories such as fashion and BPC, while the inability to operate a 1P model (inventory led) has limited the availability of private labels vs. competition which further pressures margins. Amazon’s management attrition has also increased recently, potentially signaling difficulties achieving desired scale,” the report adds.

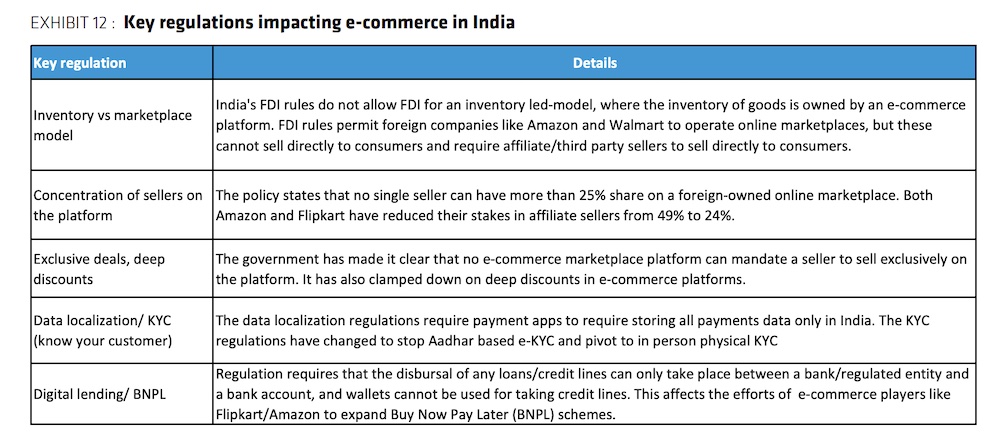

Amazon, like Walmart’s Flipkart, operates a marketplace business in India due to local regulatory requirements. It’s facing a wide range of other regulatory pushback in the country. Marketplaces cannot have a controlling stake in sellers on their platform. Amazon and Flipkart have reduced their stakes in their largest sellers. Amazon had a controlling stake in Cloudtail and Appario but has reduced it to 24%.

A single seller cannot have more than a 25% share on a foreign-owned online marketplace. No e-commerce marketplace platform can mandate a seller/brand to sell exclusively on the platform. “It has also clamped down on deep discounts,” the report adds. Additionally, a new guideline proposed by India’s central bank, if enforced, will impact Amazon’s buy now, pay later offering, the report added.

Image Credits: Sanford C. Bernstein

Other takeaways from the report:

- Amazon is less competitive in grocery and beauty and personal care categories.

- Amazon’s India Prime membership offering is much the same as in the U.S. in terms of entertainment availability, but its logistics network size pales in comparison (13 m sq. ft. vs. 375 m sq. ft.) limiting SKUs available for half-day delivery.

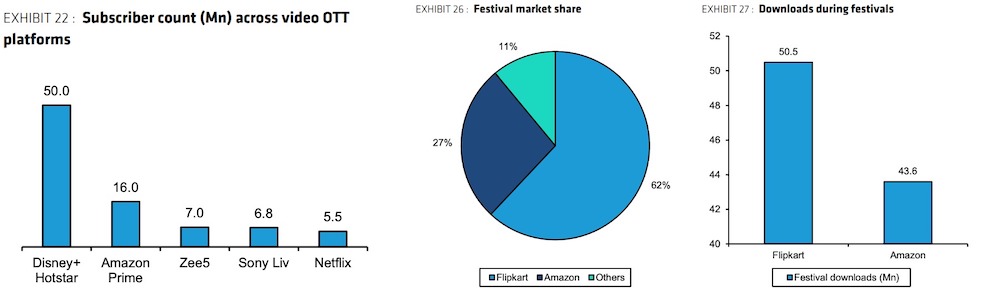

- Amazon missing out in terms of engagement metrics and download share. Flipkart was the leader during the festival season last year, capturing a share of 62% while Amazon had a share of 27%.

-

Image Credits: Sanford C. Bernstein

-

Image Credits: Sanford C. Bernstein