NEWYou can now listen to Fox News articles!

In her latest column for the Washington Post, Catherine Rampell called out Democratic lawmakers who are looking to blame other sources, such as the Federal Reserve, for the bad economy instead of coming up with policies to pull Americans out of an economic downturn.

Like President Biden and other administration officials, Rampell claimed she does not believe that the U.S. has entered a recession, despite the economy entering its second consecutive quarter of negative GDP growth – the traditional marker of a recession.

Still, she admitted that concerning economic numbers are prompting Democrats in Congress to sound “the alarm so they can duck responsibility for the inevitable political consequences.”

Rampell claimed if recession fears are that bad, these scapegoating lawmakers instead should be “highlighting this risk to prepare for the possible humanitarian fallout (by, say, patching up the tattered safety net).”

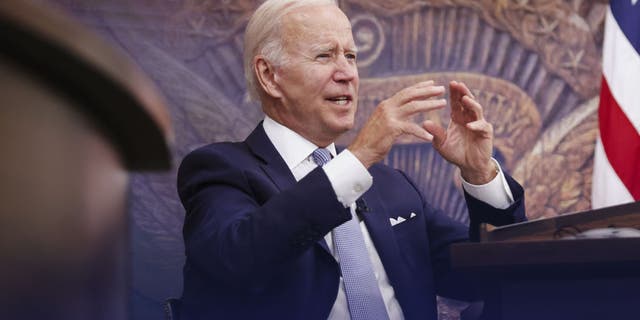

U.S. President Biden speaks in the Eisenhower Executive Office Building in Washington, D.C., US, on Thursday, July 28, 2022. The drumbeat of recession grew louder after the US economy shrank for a second straight quarter, as decades-high inflation undercut consumer spending and Federal Reserve interest-rate hikes stymied businesses and housing. (Oliver Contreras/Bloomberg via Getty Images)

JIM JORDAN SLAMS DEMOCRATS FOR ATTEMPTING TO REDEFINE DEFINITION OF A ‘RECESSION’

The author declared, “They don’t want to take the blame for any economic collapse. So they’re preemptively scapegoating the Federal Reserve, which raised interest rates again this week in an effort to tamp down inflation.”

Meanwhile, “President Biden and White House aides have been trying to reassure Americans that a recession isn’t in the offing. Nothing to see here, they keep saying, pointing to strong job growth as the rest of the outlook darkens,” she wrote, marking the two competing outlooks in the party.

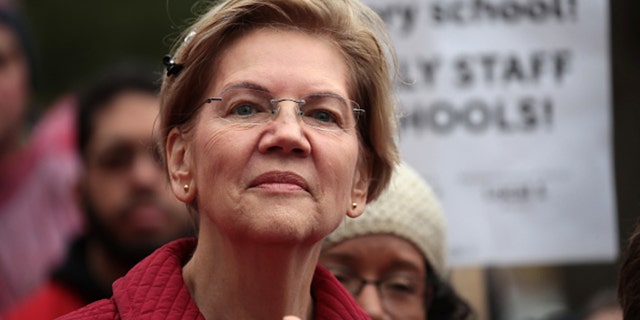

Rampell pointed out several examples of the alarmist, blame-shifting Democrats. “Sen. Elizabeth Warren, D-Mass., has warned of a ‘Fed-manufactured recession’ and proclaimed that Fed tightening will succeed only at ‘getting a lot of people fired and making families poorer.’”

She also mentioned Rep. Pramila Jayapal, D-Wash., who has “carped that the Fed is jeopardizing Biden’s promise to ‘grow the economy from the bottom up and the middle out,’ and admonished the central bank to ‘resist the urge to further raise interest rates.’”

The Federal Reserve does affect monetary policy, which is where the “main risk of recession right now lies,” Rampell acknowledged, though adding that the institution can only do so much and that it “is in a nearly impossible position.”

“Inflation needs to come down soon, before it becomes deeply embedded in the economy and expectations of price growth beget even more price growth,” she explained, adding that “interest rate hikes remain the most powerful tool available for achieving that goal.”

Washington Post columnist Catherine Rampell pointed to Sen. Elizabeth Warren, D-Mass., as one of the Democratic lawmakers looking to scapegoat the Federal Reserve for the party’s poor economic policies.

((Photo by Scott Olson/Getty Images))

BIDEN WHITE HOUSE TALKING POINTS REDEFINING RECESSION QUICKLY EMBRACED BY MEDIA OUTLETS

On Wednesday, the Federal Reserve “raised its benchmark interest rate by 75 basis points for the second straight month as it tries to bring scorching-hot inflation under control,” Fox Business reported.

Rampell’s point was that Democrats “could take some pressure off the Fed” if they “truly want to reduce the chances of recession.” That way the fate of the economy “doesn’t exclusively come down to monetary policy.” She added, “As I’ve noted many times, Congress and the president do have some tools to (modestly) alleviate inflation.”

The columnist mentioned that Democratic lawmakers could do things like “repeal the Trump-era tariffs,” “fix bottlenecks in the legal immigration system, which are contributing to labor shortages,” or “suspend shipping restrictions that raise costs for maritime transportation of goods, including oil.”

“Instead, many Democrats spend their time demagoguing about dumb stuff such as ‘corporate greed,’ which won’t affect inflation one way or the other,” she claimed, adding, “Worse, some are pushing policies that could juice demand further, such as tax cuts or broad-based student debt forgiveness.”

CLICK HERE TO GET THE FOX NEWS APP

Rampell also warned that Democrats are considering implementing “price controls,” which would “hamstring supply.”

However, if Democrats did such things, they can always just further blame the Fed. Rampell concluded, “These kinds of steps would force the Fed to raise rates even more aggressively. Which, again, makes recession more likely. At which point these very same Dems will presumably say, ‘Told ya it was the Fed’s fault!’”

Food banks struggle to meet increased demand for food due to inflation and supply chain issues.